A common reason why VCs don’t invest in a lot of startups is that the opportunity isn’t what we call “VC Backable”. This piece of vague feedback is common across the industry, but more importantly, I think it’s crucial for entrepreneurs to understand what this means. It very well may shift your fundraising strategy, or how you think about your business entirely.

A good place to start is by understanding the goals of a VC fund.

A venture firm’s ability to make a return on the capital it invests is key to this entire discussion. But just how hard is it to make money in venture capital? And how much money does a VC need to make? Let’s answer these questions first from a macro perspective than from a fund-level perspective.

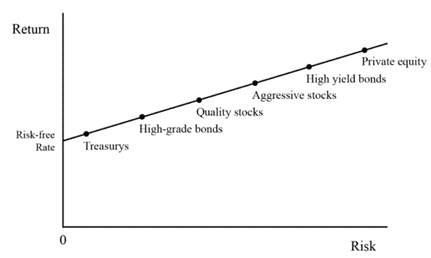

In finance, there is a concept called the Capital Market Line. A simple chart that plots different asset classes on a risk/reward plane. See below:

Coming into Focus – Howard Marks

We all know that startups are risky. But what the capital allocation line tells us is that venture capital (which rests beyond private equity on the capital market line) is a high-risk, high-reward asset class.

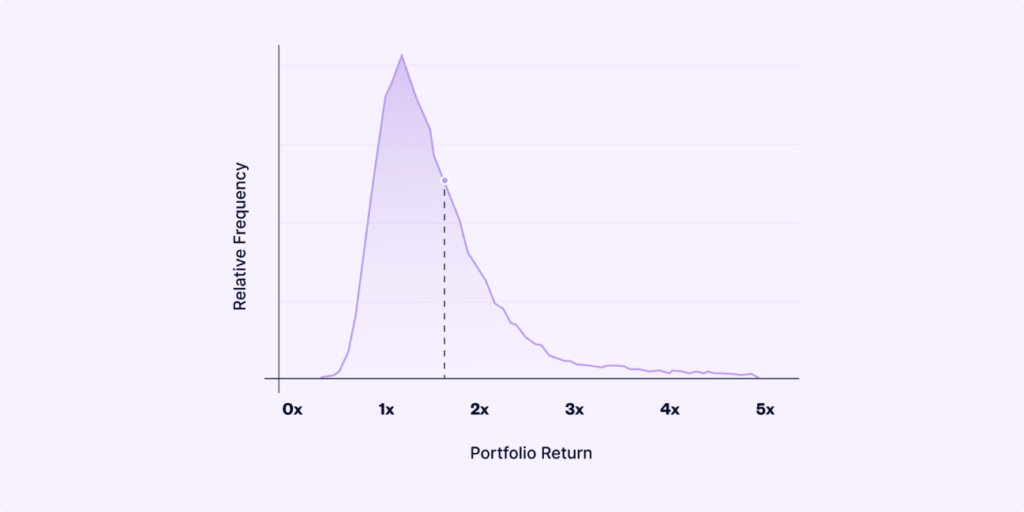

So, what does this mean? If we look at VC portfolio return data from Angel List, we can see how “high risk, high reward” manifests itself:

Angel List

This chart shows us that most early-stage funds return somewhere between 1-2x the capital invested… Which is a sub-optimal rate of return. Keep in mind that this 1-2x return is happening over a 7–10-year lifespan, so more times than not – Limited Partners (LPs), who invest in VC funds, are better off investing in a different asset class if they are purely seeking superior returns. The challenge in venture capital, however, is that not all investments are equal. If every single company a VC invests in returned 3x that would be great! But that isn’t the case. So, what does a real venture fund look like?

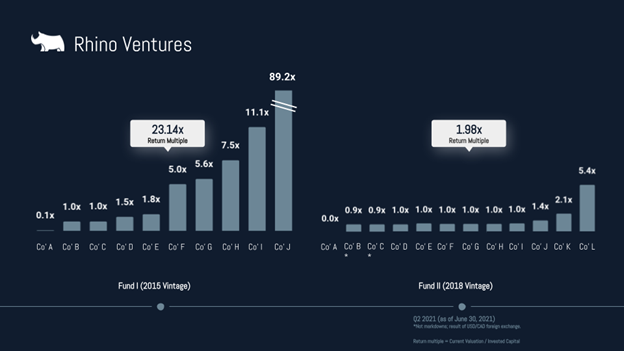

Rhino Ventures here in Canada publicly shares their fund performance. The 2015 vintage fund on the left really highlights how not every investment is equal. In this case, 50% of the portfolio is valued at less than 2x and while it certainly helps to not have many write-offs; the bulk of the returns came from just a few investments… According to their blog post, the overall fund has a return multiple of 7.1x (as of Q4 2020). Which is a top-performing fund by VC standards.

The takeaway here is that venture capital is just another asset class for investors to allocate capital towards. Performance matters, so VC investors want to deliver outsized returns compared to other investment alternatives. Let’s take a look at the performance of a few investment options:

| Asset | 10-year return |

| A Top venture fund (2010 vintage) | 40.10% |

| A Median venture fund (2010 vintage) | 13.25% |

| S&P 500 return 2010-2020 | 11.30% |

Top & median venture fund performance data courtesy of Pitchbook

Look at the top performing venture fund in our table above – coming in at 40.10% annual return which is almost 4x what you could have made in the S&P 500. This is what we call outsized returns. The median venture fund on the other hand didn’t do that much better than the S&P 500. After accounting for increased risk and illiquidity (an LPs money is locked up for 10 years in a VC fund), you likely would have been better off investing in the S&P 500 vs. the median venture fund.

So, how does this all tie back to you, the entrepreneur?

Let’s quickly summarize where we are: The goal of a VC firm is to generate outsized returns for its investors. To do this, the fund has to make high-risk, high-reward investments. With the understanding that most portfolio companies will only return 1-2x, and the bulk of returns will come from just a few investments.

So as an entrepreneur, the key question you need to ask yourself is: “Does my startup, despite all the risks, have the potential to be one of these outlier companies for an investor?

To help answer that question, consider the following:

- Market size

Market size often comes up in meetings with investors because it helps determine the size of the pond you might be fishing in. A total addressable market (TAM) of say, $100 million usually isn’t enough to get VCs interested.

So, for an investor, TAM = the size of the opportunity your company is going after. It’s important to be thoughtful when calculating the size of your TAM. If you’re using the headlines from Grand View Research or Markets & Markets reports you’re going to be wrong, and investors see right through that.

Of course, companies that create new markets (Airbnb, DoorDash, Uber, etc.) might find this challenging. But there are proxies you can use. For example, Uber first estimated their TAM based on the Taxi industry. Airbnb could have done the same with the hotel industry. Jared Sleeper has a great article on how you can explain your TAM to investors.

- Is the market large enough to support multiple $1 billion + companies?

This is key. Remember, VCs are looking for massive outlier opportunities. There are very few winner-take-all markets, but VC investors want to ensure that there is a path for the company to reach the level of valuation that they need.

Recall that since most investments only return 1-2x the capital invested, the few companies that perform very well need to generate strong returns for the entire fund. This is why investors look for companies that can achieve valuations in the range of hundreds of millions to billions of dollars.

- Do you as the entrepreneur even want to go down this path?

Funding from VCs sounds great because it solves your near-term problems. But do you really want to grow into a $1 billion+ company? Be honest here – lots of mentors / advisors / others might say “I’ll intro you to VCs, you need capital to scale, etc.” but once you take that money your signed up for the $1 billion + ride. And if that’s not what you want then I can almost guarantee you that the money won’t be worth it.

There is nothing wrong with building a business that doesn’t scale to VC-level outcomes. In fact – I’d almost argue that non-VC businesses are just as critical if not more critical to the economy. Besides, the opportunity for you + your employees to be successful doesn’t rest on being a billion-dollar business… Over the last several years there have been new funding models popping up. For example, ClearCo & Pipe are two companies looking to change the landscape of business funding that don’t require equity.

So to summarize, throughout this post I wanted to highlight two things: 1) How VCs think about their investments and why such large outcomes are required. And 2) How this ties back to you as the entrepreneur. Both from the opportunity-size standpoint (is it possible to generate outsized returns via investing in your startup) and the more personal one (do you even want to go down this road?).

Hopefully, this sheds some light on why an investor might be saying “I don’t think this is VC backable” – Often times we are big fans of the business, but we just don’t see it being able to generate the returns we need.